The Best Accountants For Limited Liability Partnerships (LLPs) in County Durham

A Limited Liability Partnership (LLP) offers the flexibility of a partnership with the liability protection of a limited company. However, LLPs have unique tax and accounting requirements that need careful management to ensure compliance and tax efficiency.

At The Tax Faculty, we specialise in supporting LLPs with award-winning, tailored tax and financial advice. Whether you’re setting up an LLP, managing partner profit allocations, or planning for tax efficiency, we provide expert guidance every step of the way.

We’re more than just accountants. Our proactive approach helps LLPs navigate financial complexities, optimise tax structures, and stay compliant with HMRC regulations.

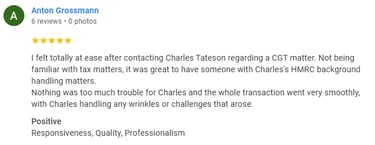

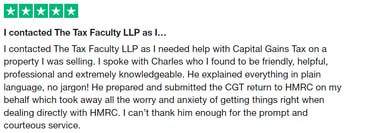

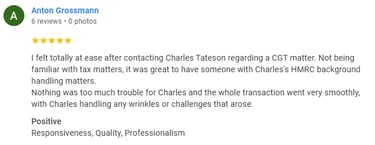

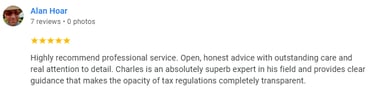

With 100+ 5-star reviews, LLPs across Durham trust us to handle their financial affairs with precision.

Expert Tax & Financial Advice For LLPs

Managing an LLP requires careful handling of partner finances, tax liabilities, and regulatory obligations. We offer comprehensive financial and tax support to ensure your LLP operates smoothly and profitably.

Our services for LLPs include:

LLP Formation & Registration: Assisting with setting up your LLP, including partnership agreements and HMRC registration.

Profit Allocation & Tax Planning: Structuring profit distributions in the most tax-efficient way for partners.

LLP Accounts & Financial Reporting: Preparing annual accounts and financial statements to meet compliance requirements.

Self Assessment Tax Returns for Partners: Ensuring each partner meets their tax obligations accurately and efficiently.

VAT Registration & Compliance: Advising on VAT for LLPs and handling VAT returns.

Ongoing Financial & Tax Planning: Providing strategic advice to optimise tax efficiency and plan for growth.

Services For Supporting LLPs

The Tax Faculty LLP Durham

Why Choose Us?

The Tax Faculty LLP

The Others

Specialist, Proactive

In-House Tax Team

Free Consultations & Calls

Fixed Fees

Aftercare Included

We prefer to get to know you and your circumstances during a free consultation so that we can identify how best to assist you.

Over £225 for 30 minutes on the telephone

You will have a dedicated Tax Faculty LLP Tax Specialist to assist you with everything that you need. No bots, no online forms. We prefer the human touch.

Reviews say that they were unhappy that they were sent to an external person who simply told them to fill in an online form with figures

We aren't just accountants - we're Tax Professionals with years of experience working for HMRC and working for clients like you. We provide advice to reduce tax bills and solve complex problems.

Service is limited to filing tax returns unless you pay more fees for additional consultations which work out at over £450 per hour.

Once we've identified how best to assist you, we provide a fixed fee quote to carry our the work on your behalf. You will be safe in the knowledge that you will never pay more than this fixed fee.

If more time or advice is needed, you pay more. This leads to unexpected and high fees being paid.

Each of our clients are provided with HMRC Fee Protection Insurance, meaning that if HMRC ask any questions, we respond on your behalf - with no added fees being charged to you.

If HMRC ask questions in relation to your tax affairs - guess what? That's right, you pay an added hourly fee for any replies to be written.

Tax Advice

Professional, Award-Winning Tax Advisors and Accountants in Durham

We understand that your business is unique. That’s why we don’t offer cookie-cutter solutions. Our approach is centred around high-quality, proactive tax advice—we work closely with you to identify opportunities for tax savings, helping you plan for growth and long-term success.

What sets us apart:

Award-Winning Service – Recognised for excellence in client service and accounting expertise.

100+ 5-Star Reviews – Proven success stories from businesses just like yours.

Tailored Advice – We understand your business goals and tailor our services to match.

Frequently Asked Questions for LLPs

Q1: How is an LLP taxed compared to a limited company?

Unlike a limited company, an LLP doesn’t pay Corporation Tax. Instead, each partner is taxed individually on their share of the profits via Self Assessment. We help LLPs and their partners structure income tax-efficiently.

Q2: Do all LLP partners need to file a tax return?

Yes, each partner must file a Self Assessment tax return to report their share of the LLP’s profits. We ensure accurate and timely submissions to avoid penalties.

Q3: Can an LLP be VAT registered?

Yes, if the LLP’s turnover exceeds the £85,000 VAT threshold, it must register for VAT. Voluntary registration may also be beneficial in some cases. We provide VAT advice tailored to LLPs.

Q4: How should LLPs allocate profits among partners?

Profit allocation is typically outlined in the LLP agreement, but strategic planning can optimise tax efficiency. We offer advice on structuring partner distributions in a way that maximises take-home income while remaining compliant.

Tax Troubles? We're here to help

We can solve your tax problems, with ex-senior expert HMRC inspectors here to help to take the stress away from your tax worries.

We do everything for you, including filing returns and giving advice that may help to reduce the amount of tax that you owe.

Our guarantee to you - You will pay the lowest amount of tax possible, while complying with the law.

Contact us free on 0800 0016 878, email info@thetaxfaculty.co.uk or fill in our handy form and on of our experts will get back to you as soon as possible.

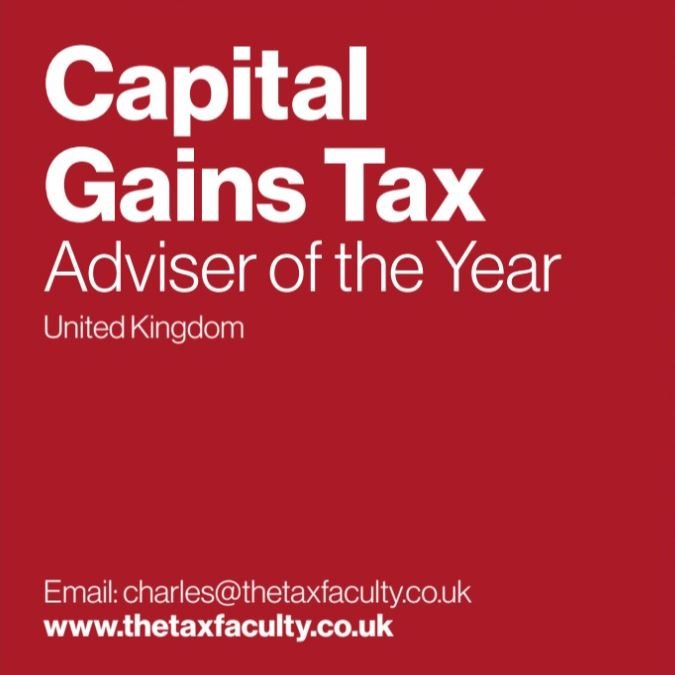

Capital Gains Tax Expertise: The Tax Faculty LLP Managing Partner Charles Tateson Named UK Capital Gains Tax Advisor of the Year

The Finance Monthly Taxation Awards recognises the achievements of tax professionals from around the globe.

Winning such an award is no small feat. It is a reflection of hard work, extensive knowledge, and an ability to navigate the intricacies of the UK tax system.

Read more about Charles and the award here.

How We Work

Step One

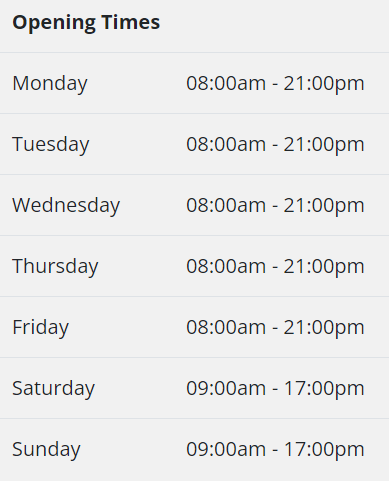

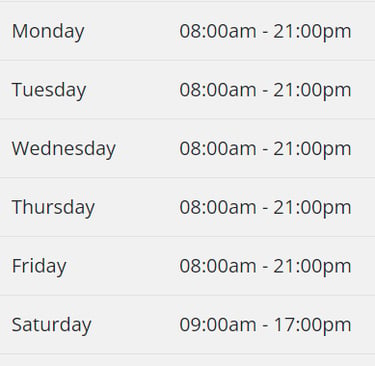

We start with a completely free and confidential consultation. This can take place by way of a meeting (over the telephone, video meeting or in person) or by way of email. We get to know you, your circumstances and your requirements.

Step Two

We analyse your situation and your needs in order to identify how best we can assist you. This might involve filing tax returns on your behalf with HMRC, providing advice on reducing your tax liability now and in the future, or a combination of such work.

Step Three

Should you wish to engage us, we would provide you with a fixed fee quote for the work required to solve all of your tax worries. We then complete our work with the highest levels of professionalism, keeping you updated at every stage and taking the stress away.

Contact Us

Contact us today on freephone 0800 0016 878 for a free consultation on all tax and accounting issues, or fill out the handy form below and we'll get back to you as soon as possible.

Alternatively, you can email us at info@thetaxfaculty.co.uk or complete the handy form below.

(Please note, non-UK callers may need to call 0207 101 3845 if your line cannot connect to our 0800 number)

Feel free to contact us through WhatsApp - we accept calls and messages.

Simply click the WhatsApp button below:

The Tax Faculty LLP - info@thetaxfaculty.co.uk

Call us on 0800 0016 878 for a free consultation

Copyright © 2025 The Tax Faculty LLP - All Rights Reserved